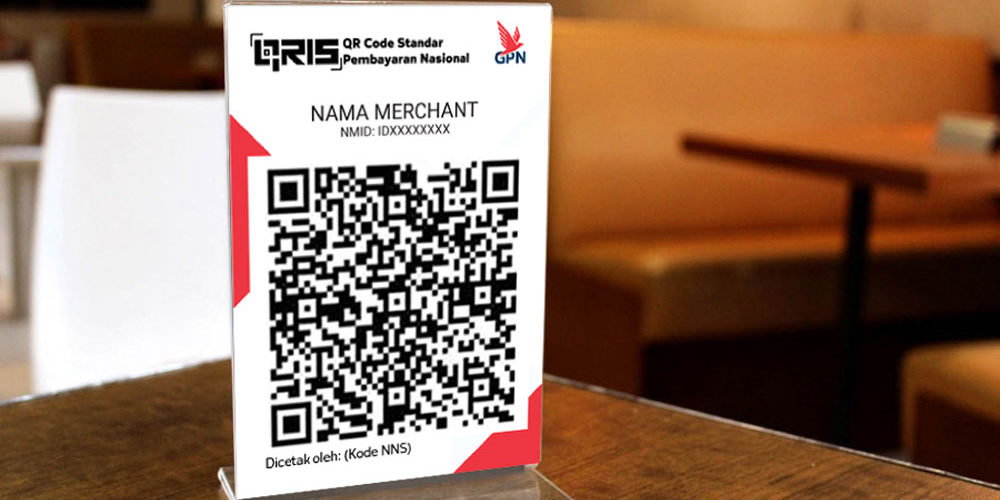

Digital-based payment methods now come in various forms. From digital wallets to conventional banking services that have entered the digital realm. In response to the growth of digital payment tools, Bank Indonesia has mandated that all non-cash payment service providers use the Quick Response Code Indonesia, commonly known as QRIS.

QRIS is a payment standard that utilizes QR codes to make transactions easier, faster, and more secure. It allows merchants to accept payments from various digital wallets and banks using a single QR code. On the consumer side, apart from being an alternative payment method, transactions are faster compared to cash payments and consumers do not need to wait for change.

Bank Indonesia and the Monetary Authority of Singapore have been collaborating on cross-border QR code-based payments since August 2022. Bank Indonesia is planning to officially launch the use of QRIS in Singapore in the fourth quarter of 2023. The collaboration with Singapore is in its final stages and is expected to be implemented before the end of the year. This means that Indonesian citizens will be able to shop using QRIS in Singapore while on vacation.

Recognizing the rapid increase in QRIS usage, a financial technology (fintech) company in Indonesia has collaborated with ERASYS Consulting as a software developer to implement the advantages of QRIS. Currently, QR transactions and claims are still processed manually, lacking a facilitating application to simplify the process. Additionally, based on QRIS transaction data, its usage increased sixfold in 2020 compared to 2019, necessitating the creation of such an application.

The aim of this project is to support and facilitate an application that can serve all QRIS users in the fintech company, enabling automatic processing by the system and improving efficiency and effectiveness between users and QRIS providers. To achieve this goal, some changes to the transaction flow are necessary.

Initially, all transaction and claim processes were done manually. Users manually claimed data through email to the operator team. The reporting team then entered this claim data into the database, and the settlement team calculated the debit and credit claims. The process ended with the settlement team sending information about the claim status via email.

Three out of the four processes have been altered to run automatically. The new process still requires users to claim data manually, but the subsequent steps are automated. Webclaim will send the data file to SFTP (Secure File Transfer Protocol) and the database using a scheduler. Automatic calculation of debit and credit will be done by Webclaim, and it will periodically update the claim status based on actions taken (using automated parameters). This automation provides competitive advantages, visibility, effectiveness, and an efficient process flow.

Transitioning from a manual claim process to an automated one with the help of Webclaim brings improvements in process efficiency. In the previous process, many time-consuming tasks, such as number calculations, reporting, and document handling, were involved. These manual steps often led to errors or delays due to data accumulation. However, with the implementation of an automated system, such inefficiencies can be significantly reduced. This system optimizes the claim process by automating number calculations, digitizing documents, and sending periodic reports. As a result, the claim process becomes faster, reducing the burden on claimants and staff. Overall, this transition increases process efficiency by reducing delays, errors, and manual efforts, leading to improved productivity and smoother operations.

Contact us to learn more about how ERASYS Consulting can assist your business in transitioning from manual processes to automated ones with the Webclaim system.